AI in Accounting Is No Longer the Future for CA Firms

AI in accounting is no longer a buzzword—it’s a daily reality inside modern CA firms.

In 2026, Chartered Accountants are handling:

- High client volumes

- Tight GST & compliance deadlines

- Shortage of skilled junior accountants

- Pressure to reduce costs and errors

Yet many firms still rely on manual Excel work and repetitive Tally entries.

This is where AI-driven accounting automation changes the game.

Let’s look at practical, working AI use cases that CA firms can actually implement today.

Why AI in Accounting Matters for CA Firms

Traditional accounting systems struggle with:

- Manual data entry errors

- Slow bank reconciliation

- Dependency on junior staff

- Repeated compliance work

AI in accounting for CA firms focuses on one goal:

👉 Reduce manual work while improving accuracy and speed.

Tools like Excel to Tally software apply practical AI logic to everyday accounting tasks—without complex setups.

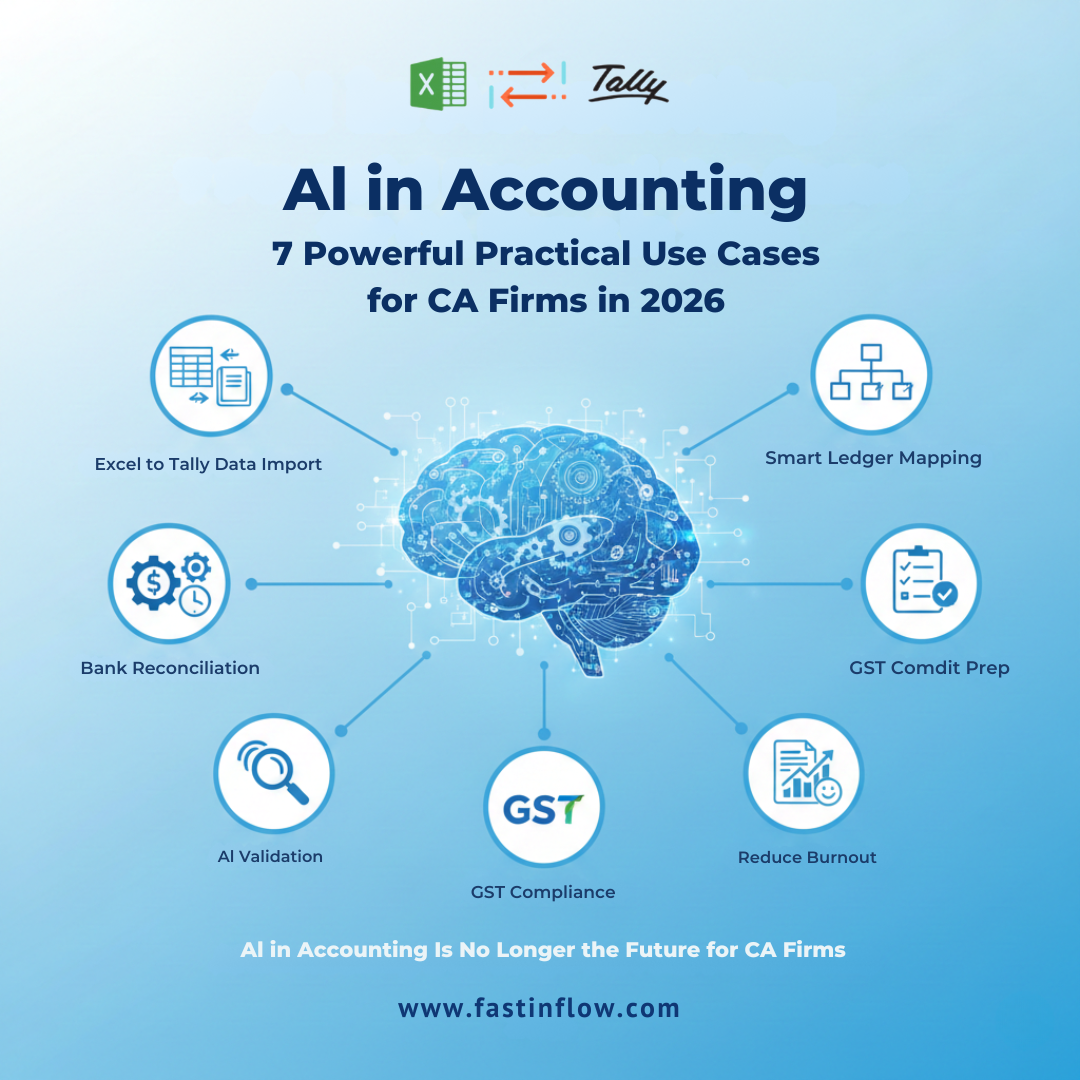

7 Practical AI in Accounting Use Cases for CA Firms

1. AI-Based Excel to Tally Data Import

AI helps read Excel data intelligently and convert it into:

- Sales vouchers

- Purchase vouchers

- Journal entries

- Payment & receipt entries

With Excel to Tally automation, CA firms can import thousands of entries in minutes, eliminating manual posting errors.

2. AI-Powered Bank Statement Reconciliation

Bank statements are messy different formats, narrations, and transaction styles.

AI in accounting helps by:

- Reading bank narrations

- Identifying contra entries

- Auto-mapping debit and credit transactions

- Detecting duplicates

This dramatically reduces reconciliation time during audits and GST filing.

3. Smart Ledger Mapping Using AI

One of the biggest challenges for junior accountants is wrong ledger selection.

AI-enabled Excel to Tally tools:

- Auto-map ledgers from Excel

- Reuse past ledger logic

- Reduce dependency on Tally expertise

This ensures consistent accounting treatment across clients.

4. AI Validation Before Tally Import

Before data enters Tally, AI checks for:

- Missing ledger names

- Incorrect voucher types

- Invalid GST rates

- Mismatch totals

This prevents errors before they reach books saving rework during audits.

5. AI in Accounting for GST Compliance

AI simplifies GST by:

- Structuring sales & purchase data

- Preparing GST-ready reports

- Helping reconcile GSTR-1 and GSTR-3B

- Reducing notice risks

For CA firms handling multiple GST clients, this is a huge productivity boost.

6. Faster Audit Preparation with AI Automation

During audits, time is lost in:

- Cleaning data

- Rechecking entries

- Verifying reconciliations

AI in accounting ensures:

- Clean, structured books

- Consistent voucher entries

- Faster audit finalization

This improves both client satisfaction and firm profitability.

7. Reducing Junior Accountant Burnout

Junior accountants struggle not due to lack of knowledge but due to manual workload.

AI-driven Excel to Tally automation:

- Reduces data entry pressure

- Improves confidence

- Allows juniors to focus on learning, not typing

Result? Better retention and faster skill development.

How Excel to Tally Software Applies AI in Accounting

Excel to Tally software uses practical AI logic, not complicated buzzwords:

- Smart narration reading

- Automatic voucher identification

- Ledger intelligence

- Bulk data handling

- Error detection before import

This makes it ideal for small- to mid-size CA firms looking to automate without outsourcing.

Conclusion: AI in Accounting Is a Competitive Advantage

CA firms that adopt AI in accounting:

✔ Deliver faster work

✔ Reduce errors

✔ Control costs

✔ Scale without hiring more staff

You don’t need futuristic tools; you need automation that works today.

Ready to Implement Practical AI in Your CA Firm?

Instead of outsourcing repetitive accounting work, automate it in-house using Excel to Tally software and experience real productivity gains.