As a business owner, it is critical to keep accurate and efficient records of all sales transactions. Tally is a well-known accounting program that offers a complete solution for managing your finances, including sales. However, if your sales data is stored in an Excel spreadsheet, manually entering the data into Tally can be time-consuming and error-prone.

Fast In Flow’s Excel to Tally software allows you to import sales data from Excel with GST, saving you time and reducing the possibility of errors. This blog will walk you through the process of importing sales from Excel to Tally with GST.

Step 1: Create an Excel spreadsheet.

Make sure your Excel file is in a format that Tally can read before you upload your sales data into Tally. You must save your Excel file in one of the tab-delimited or comma-separated values (CSV) file formats since Tally accepts these types of files.

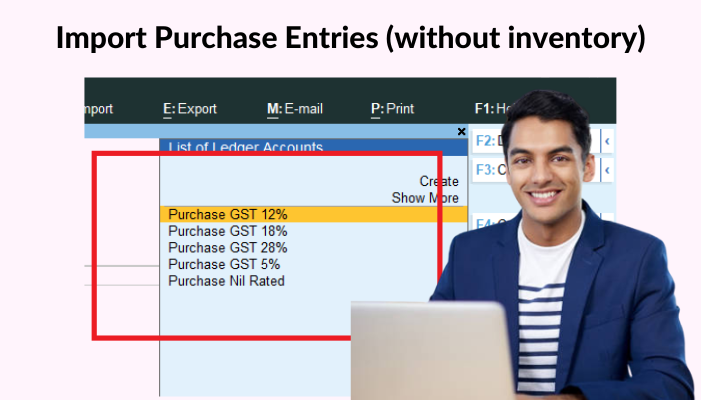

Step 2: Importing the Data into Tally

You can import your Excel file into Tally once it has been properly formatted. This is how:

Use Tally to connect “Fast In Flow – Excel to Tally”

Open Tally and select Display > Daybook > CSV/Tab-Delimited from the Gateway of Tally menu.

Choose the required CSV or Excel file from your computer by selecting the Import option.

The data fields in your Excel file will now be automatically recognized by Tally and mapped to the appropriate fields in Tally.

Map the data in the next window.

Make sure that the GST fields are accurately mapped to the appropriate fields in Tally and then map the data fields in the file to the pertinent fields in Tally on the next screen. This crucial step makes sure that the GST information is appropriately imported.

Step 3: Import the Data

You can now import the data into Tally after the mapping is finished. Simply click the Import button to get started. Once the data has been imported, Tally will generate the necessary invoices, debit/credit notes, and other transactions, together with the GST information.

Step 4: Verify the Imported Data

It’s crucial to check that everything was correctly imported after the data has been imported. This involves ensuring that the GST information is accurate and that all transactions have been imported.

Step 5: Take a Backup

Take a backup of your Tally data before importing the data to guarantee that you have a copy of your data in case anything goes wrong with the import.

In conclusion, importing sales from Excel to Tally with GST is a simple procedure that can help you save time and lower the likelihood of making mistakes. You can make sure that your sales data is imported accurately and appropriately by following the instructions provided in this blog.

Get a FREE Demo of Excel to Tally Software.